The statement from DMGT:

Summary of the period:

• Revenue for the third quarter of £495 million, up an underlying# 2% on last year.

• Continued good underlying# growth from our B2B businesses.

• Weaker national advertising revenues, reflecting the fragile UK consumer economy.

• Mail titles continued to improve their market share.

• Continued focus on operational efficiency.

• Full year earnings* expected to show modest growth.

• Net debt reduced by £29 million to £820 million.

Martin Morgan (pictured), Chief Executive, said: "Trading in the third quarter was mixed. There was continuing strength in B2B from our international portfolio of market-leading businesses with all divisions performing in line with our expectations. In contrast, conditions within our consumer businesses have been tough with advertising revenue weak over the quarter. We still expect to achieve some growth in earnings* per share for the full financial year, driven by the continued strength of our B2B operations which reflects the benefits of DMGT's diversification strategy, despite the volatile and uncertain market conditions faced by the UK consumer businesses."

Business to business ('B2B')

Revenues from the Group's B2B operations in the quarter were £229 million, an underlying# increase of 8% on the corresponding period last year. Reported revenues were 2% lower, due primarily to the impact of a lower US dollar. We continue to expect to achieve good growth for the full year, driven by solid subscription revenues and the performance of our major trade shows, and are maintaining our guidance for the outlook, as reported in May.

Risk Management Solutions' revenues were £41 million, an underlying# increase of 7%. Cumulatively, underlying# revenues rose by 9% for the nine months to 30th June, 2011, compared to the same period in 2010, reflecting continued growth from RMS's core modelling business.

The revenues of dmg information were £60 million, 5% lower on a reported basis, but with an underlying# increase of 1%. As expected, the property information companies generated 6% underlying growth with both Landmark (UK) and EDR (US) performing well despite the difficult market conditions. Hobsons and Genscape, serving the education and energy information markets respectively, continued to grow well. However, trading in the financial information market for Trepp and Lewtan remained subdued as new bookings continued to be offset by higher attrition rates as speculative players exit the market. Sanborn, our geospatial business, continued to hold back overall growth, as revenue declines persisted in a challenged market cycle. As a result, the underlying# revenues of the non-property companies were lower overall by 2%.

The underlying# revenues of dmg events rose by 17% to £26 million. Reported revenues fell, as expected, by 12%, due to the absence of the biennnial Global Petroleum Show and the impact of exchange rates. Bookings for the August New York International Gift Fair are currently higher than last year.

Euromoney Institutional Investor released its IMS on 15th July. Revenues for the quarter rose by an underlying# 10% to £102 million, driven by another strong performance from the event businesses. The reported increase was 4%. Subscription revenues rose by an underlying# 10% due to continued strong growth from Euromoney's premium electronic information services. There was an underlying# 23% increase in sponsorship revenues. Delegate revenues from events also performed well, offset partly by a weaker performance of the training division. Since the start of June there has been an encouraging pick up in advertising sales and delegate bookings.

Consumer media

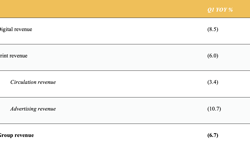

Revenues from A&N Media in the quarter were £266 million, 6% lower on an underlying# basis and 7% lower on a reported basis. Overall headcount continues to be reduced, standing at 7,010 at 2nd July, 2011, 8% lower than at the start of the financial year. The reduction was mainly at Northcliffe Media and the printing division, though investment in additional resource has been made at Mail Online and at the Jobs and Property digital businesses. A&N Media has confirmed its decision to relocate the Surrey Quays printing operation to a green field site in Thurrock, Essex.

Associated Newspapers' total reported revenues for the quarter fell by 6% to £207 million, an underlying# fall of 5%. Circulation revenues were 3% lower. Both the Daily Mail and The Mail on Sunday continued to improve their market share. The launch of the weekend Mail Rewards Club has generated additional sales for both titles, with The Mail on Sunday reporting sales above the prior year in both May and June. The cover price of the Daily Mail weekday editions was increased by 5p to 55p on Monday 18th July 2011. This price increase will mitigate some of the continuing high cost of newsprint and the recent decline in advertising revenues.

Total underlying# advertising revenues were 7% below last year with those for the five weeks of June down 9% against a backdrop of High Street uncertainty and a nervous consumer and retail market.

Underlying advertising revenues from Associated's newspaper operations were down by 10% in the quarter (print down 12%, digital up 51%). Retail, the largest category, declined by 15% with travel and financial each falling by 9%. Revenues from other categories were in total 7% lower than last year. Mail Online continues to grow strongly with revenues up 59% in the quarter. There were around 70 million unique visitors in June, 62% higher than June 2010 and attracting over 4 million average daily unique visitors to the site during the month, representing growth of 67%, compared to the same month a year ago.

The revenues of Associated's digital only businesses grew by 2%. Strong growth was experienced from recruitment and property, but the travel and motors businesses continue to face challenging market conditions.

Whilst the outlook remains uncertain and, as usual, visibility on future newspaper advertising performance is very limited, the July to September comparatives are less demanding for Associated and there are early signs of improvement in July trading with advertising revenues only 3% below last year after the first three weeks of the month.

Northcliffe Media's total revenues for the quarter were down by 10% to £59 million, a small improvement on the 11% decline experienced in the previous quarter.

Circulation revenues fell by 8% compared to last year. Advertising revenues were 10% below prior year levels, compared to the 12% seen in the previous quarter. By major category, recruitment (down 35%), public notices (down 13%) and property revenues (down 6%) were all lower, with retail, the largest category, being less than 1% below last year (down 6% in the previous quarter).

Costs continue to be well below prior year levels, a 5% reduction in the quarter driven by reduced staff and distribution expenditure in particular. Headcount was reduced by a further 80 (3%) during the quarter to 2,720, some 410 (13%) lower than at the start of the financial year.

Trading in the last four weeks has seen advertising revenues 8% below last year.

Net debt / financing

Net debt at 2nd July, 2011 was £820 million, down from £849 million at 2nd April, 2011, as the Group continues to generate strong cash flows to pay down debt. Further to recent announcements, the Group is considering offers for its U.S. retail-focused events business. Good progress has been made with obtaining the necessary regulatory and shareholder approvals for Euromoney's acquisition of Ned Davis Research Group, the US-based provider of independent financial research to institutional investors which is expected to complete at the end of this month.

Notes

# Underlying revenue is revenue on a like for like basis, adjusted for acquisitions, disposals and closures made in the current and prior year and at constant exchange rates.

* References to earnings are to adjusted earnings which exclude exceptional items, impairment of goodwill and intangible assets, and amortisation of intangible assets arising on business combinations. Adjusted earnings per share for the 2009/10 financial year (as restated) were 46.3p.

DMGT's estimated weighted average number of shares in issue for the full year is currently 382.8 million (2010: 383.0 million). The total number of shares in issue (after deducting shares held in treasury) is currently 382.8 million.