As reported by DMGT: The Group has revealed an increase in underlying revenue of 2% for its B2B businesses. The consumer business has shown an encouraging performance with underlying revenue up 1% and underlying profit up 10%, with MailOnline moving into operating profit during the final quarter.

Paul Zwillenberg, Chief Executive, said: “We are pleased with another encouraging performance in our media business, and our B2B businesses reported robust revenues amid some challenging conditions. We have completed our strategic review, announced a bold strategic vision; Intelligent Insights. Consumer Connections, and embarked on a new Performance Improvement Programme to position DMGT for future success. I want to thank everyone at DMGT for their hard work in delivering this performance during a period of intense change for the Group.”

The Group’s newly-defined strategic vision, Intelligent Insights. Consumer Connections, focuses on harnessing DMGT’s competitive advantages and expertise across its B2B and consumer businesses. This, alongside a new Performance Improvement Plan, will position the Group for future growth and continued innovation.

Performance by business

Risk Management Solutions saw revenues increase by 14% on a reported basis and by 2% on an underlying basis, despite continuing consolidation in the re-insurance industry. Operating margin for the year was 14%, which is broadly in line with guidance provided in December 2016.

dmg information continued to grow with overall revenues up an underlying 2%. Hobsons delivered strong underlying growth of 9%, whilst Genscape continued to deliver underlying growth. The US Property Information businesses collectively delivered underlying revenue growth of 5%, whilst the European businesses were affected by continued uncertainty in the UK residential market where mortgage approvals were lower than the previous year.

dmg events saw an underlying revenue increase of 3%, whilst the operating margin reduced slightly to 26%, reflecting investment in launching new events and marketing to fuel future revenue growth. The team produced a resilient performance despite the continued weakness in the oil price.

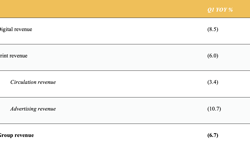

dmg media saw its revenue grow by an underlying 1% to £683 million. There was strong underlying growth of 18% for digital advertising, a decline in print advertising and circulation revenues remained stable on an underlying basis. Difficult conditions in the newspaper advertising market eased slightly, improving the underlying decline in print advertising to 5%, compared to 12% last year. Operating profit was in line with the prior year, an underlying increase of 10%, with MailOnline moving into operating profit during the final quarter.

Overall the Group has made good progress against its strategic priorities set out last year by CEO Paul Zwillenberg. Simplifying the management structure has led to faster decision making and is strengthening operational execution. DMGT’s stake reduction in Euromoney, restructuring of Hobsons, the sale of Elite Daily and the planned disposal of EDR has sharpened its portfolio focus. Financial flexibility has also improved, as net debt to EBITDA is now at 1.4 times, the lowest level in over 20 years.

Links / further reading: Read the full results here.