B2B print ad pages were down 10% last year and 27% in January 2009 alone, while ad revenues were down 7% and 21% for those periods, respectively, according to American Business Media’s Business Information Network. January marked the 29th consecutive month of ad page declines and 27th of ad revenue declines. ABM, not in the habit of being pessimistic, is now projecting that print ad revenue could drop by up to 22% this year.

Consumer magazine ad pages declined 11.7% last year (17% in Q4 alone), after three years of flat to slightly down numbers, among Publishers Information Bureau tracking service member titles. And ad revenue dropped 7.8%. Research resource eMarketer is projecting that consumer magazine ad revenue will dive 16% this year, decline by single digits in 2010 and 2011, and perhaps show a slight rebound (4%) in 2012. Amazingly, 110 magazines launched in this year’s first quarter… however, 95 folded during the same period, according to Oxbridge’s Mediafinder service.

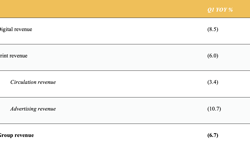

Newspapers look most bleak of all. US newspapers’ ad revenue dropped 16.6% last year, and their online ad revenue (which had been growing at double-digit rates for years) declined by 1.8%, according to Newspaper Association of America data. Total paid newspaper circulation was 50.7 million as of 2007, a drop of 19.5% from a peak of over 63 million in 1984. There were still 907 US newspapers as of 2007 (down just 10 from 2003). But when the ’08 and ’09 numbers are available, they’re bound to be shockers. The rapidly growing list of venerable newspapers joining the dead pool, and major newspaper companies filing for bankruptcy protection, is positively stunning.

Even the US book publishing industry is challenged. Dollar sales declined 2.8% last year, although January 2009 saw a 3.6% increase, per the Association of American Publishers.

In short, as elsewhere, the print picture in the US is not exactly uplifting.

Some signs of fight back

And yet… here, as elsewhere, media companies once entirely print-dependent — magazine, newspaper and book — are fighting back.

For example, truly integrated, centralised customer databases, elusive for many years due to technical and internal politics obstacles, are finally becoming a practical reality at major consumer magazine publishers, as well as B2Bs. The former are starting to realise significantly enhanced consumer marketing efficiencies from modeling and cross-marketing (both of products and across traditional and online channels). B2Bs are realising similar audience development benefits, and translating greater market intelligence into cross-channel advertising / sponsorship marketing advantages.

On-staff SEM specialists are becoming fairly common at large magazine publishers, and online initiatives ranging from acquisitions of affinity sites to honing audience targeting for magazine-branded enewsletters and other touchpoints to new and existing customers are ubiquitous.

True, the wisdom of various free versus paid or hybrid online access models being tried is very much TBD. Print-originated companies haven’t been quick enough to jump into new opportunities like social media, and newspapers in particular seem to be floundering at employing new channels.

We’re also seeing some print media respond with less strategic (some might say desperate) moves. The NY Times taking front-page advertising and magazines ranging from US Weekly to Scholastic Parent & Child obscuring their covers with ads strikes many journalists as horrific. Personally (since cover advertising is fairly obviously advertising), I’m more worried about sponsored content passing for editorial content — not to mention the huge challenges presented by blatant reuse / outright full republishing by websites of content that cost the originating media entities huge investments in staff talent and time.

Experimentation rules

The most cogent summary of the media revolution that I’ve read to date was written by Clay Shirky, an expert on decentralised technologies, on his blog (www.shirky.com/weblog). His essay, Newspapers and Thinking the Unthinkable, is a must-read by all media, as his core points are highly relevant to all (and the direct inspiration for the headline on this column).

Essentially, Shirky points out that struggling to adjust old media business and journalism models is both futile and counterproductive. The only “strategy” that makes sense is to accept that the internet has destroyed the underpinnings, recognise that no one knows how all of this will pan out, replace structures “perfected for industrial production” with ones “optimised for digital data,” and experiment like crazy.

“Experiments are only revealed in retrospect to be turning points,” Shirky wrote, and the answer to the question ‘If the old model is broken, what will work in its place?’ is: “Nothing will work, but everything might. Now is the time for … lots and lots of experiments, each of which will seem as minor at launch as Craigslist did, as Wikipedia did…”

To put it in different context, as circulators / direct marketers have always known, testing — trying, failing and trying again — is the only route to eventual success. Increased tolerance for risk and failure on management’s part may prove the true winning strategy in this revolution.