For all the black holes that threaten to engulf the business, there are also hotspots of opportunity and operational excellence.

Three big numbers to put the industry in context

- US$182 billion. The combined global revenues of News & Magazines (N&M) in 2019, making it one of the biggest media sectors ahead of Consumer Books, Music, Video Games, Radio or Cinema.

- 91%. The percentage of global N&M circulation revenues still accounted for by print. Despite the growth in digital platforms, print still drives circulation revenues and delivers much higher margins.

- 6%. The percentage of global press sales that are cross-border – a specialist, but significant global business, especially for UK publishers as English remains an important international language.

The market is tough, fast-moving and massively disrupted.

The long view of a changing industry

Over the last six years, the Distripress Circulation Monitor (DCM) has tracked a rapidly changing industry…

- In 2014, the business was getting to grips with the prospect of terminal decline.

- In 2015, the mood had moved on from despair and denial regarding what was happening to a grim determination to face up to all the challenges.

- In 2016, there was much more optimism evident, as companies were testing new business models and finding a way forward.

- In 2017, the pressures which had been building up over previous years exploded into the open. The result was a series of company closures, mergers, acquisitions and consolidation, together with some unexpected partnerships. Both business confidence and business performance among Distripress members were falling.

- In 2018, confidence began to recover, with the underlying business indicators looking a little more robust and Distripress members thinking more creatively and positively at the potential for opportunity in the ongoing changes.

The current picture is that the market is tough, fast-moving and massively disrupted. Confidence and business performance within the press industry are both down. The dominant theme running through the 2019 report is how the world is fragmenting. Economic patterns, tech trends, political and social developments, business models, consumer demands – in every area, there is rapid and accelerating change, which is taking place at different rates and in different ways in different parts of the world. This makes it more difficult than ever before to generalise about what is happening and can give the impression of there being utter chaos.

Yet, beneath the confusing surface turbulence, there are two positives. Firstly, there are still hotspots of opportunity and operational excellence – both geographically and by market sector. Secondly, there are also patterns and constants behind the volatility. Tracking and measuring them, is the purpose of the DCM.

2019 was the year for the middlemen in the supply chain to feel the heat.

Geographic hotspots

The variations by country and region around the world show significant differences. For example, India and Kenya are currently showing N&M strong growth, while the Czech Republic and Greece are declining most rapidly.

Market sector hotspots

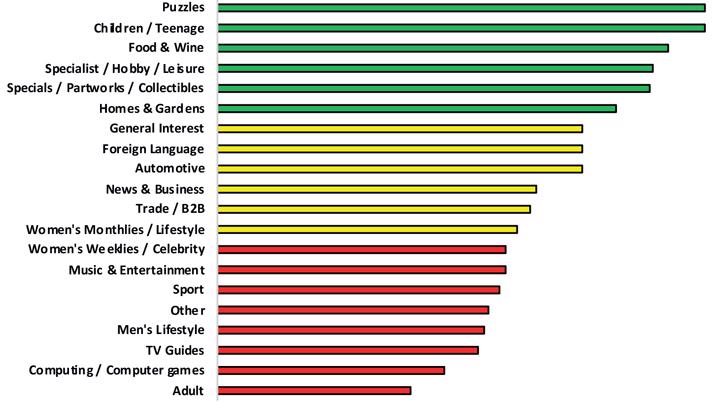

Globally, all market sectors are dropping in terms of their current year-on-year sales trends, but they fall into three broad bands (see graph):

- Tier 1 (green): Behind the overall global picture of decline, all of these categories are showing local hotspots of growth in several territories.

- Children / Teen is one of the most buoyant categories, but is also very variable from territory to territory. It is driven by launches and short-lifecycle products which can mean a very erratic picture from year to year.

- Puzzles are another strong category, but with much greater underlying stability and consistency.

- Food & Wine and Homes & Gardens are also in the top tier, but are quite variable in their performance from territory to territory, whereas Specialist / Hobby / Leisure is more consistent.

- Tier 2 (yellow): Sharper decline, but with local hotspots of stability, with General Interest and Automotive the most consistent performers.

- Tier 3 (red): Serious and universal decline, with Adult by far the weakest category.

Tracking the operational metrics

The DCM report digs into a whole range of operational metrics which track the trends of the industry. The key issues are:

- Business performance & confidence. These were both well down in 2019 in comparison to 2018: 23% of companies saw business growth – this is well down on the previous year’s 31%. And 24% of companies were feeling more confident about their business than a year ago, well down on the 36% in 2018. There are two important provisos to these figures. Firstly, behind the negative topline scores, there is still a resilience and “can do” attitude in evidence, accepting the current market conditions as a simple fact of life. Secondly, both measures are much more negative for Wholesalers & Distributors than for Publishers, who seemed to experience more of their financial pain and anxiety in 2018. 2019 was the year for the middlemen in the supply chain to feel the heat.

- Export trends. While sales are still trending down, the decline appears to be slowing, with the profitability of export remaining robust: 71% of publishers make a profit from their international sales, with 25% breaking even. Promotion budgets are reducing, but are being targeted into fewer, selected specific markets.

- Retail universes for N&M. There has been a slight acceleration in the decline of N&M retailers to -5% per year. And the grocers continue to gouge share from traditional N&M specialists.

- Internal organisational change. This is significant and accelerating, but at the same time seems more under control as organisations become more agile.

- Supply chain change. The number of markets seeing uncontrolled, structural change appears to be reducing, but where it is happening, the nature of that change is becoming more radical. Yet there is a widespread feeling that there is a real need for the links in the supply chain to work more co-operatively to drive efficiencies and reduce process duplications and hand-ons.

The immediate action plan

Two areas stand out with strong scores. In this year’s survey, “Improving the efficiency of internal processes & practices” has edged ahead of the second-place area (“Developing new products & services”): this activity had much lower scores a few years ago, but has come to the top of the list over the last two years – a clear sign that all companies in every sector are looking at new ways to develop their businesses through diversification and new revenue streams. Here, the scores are significantly stronger for Wholesalers & Distributors than for Publishers, as they are really focusing on diversification activity more than ever before.

Grinding cost control remains a permanent feature of every operation. Worryingly, two areas of important investment have dropped scores significantly over the last year – IT & Tech and Staff. It is clear that many organisations are simply not building these competencies and investing in these areas that they need in order to survive in the long term.

New opportunities currently

For Publishers, there remain the two key priorities which featured in the 2018 report, but which are now mentioned with more focus and a greater sense of urgency:

- Growing the international footprint, but generally via digital channels.

- Shifting the focus from ad hoc, single copy activity to repeat, subscription-based mechanics.

If the Publisher development plans are becoming more focused, the response of Wholesalers & Distributors has been to create an even longer list of possible diversification activities. The two big areas remain growing the range of publisher services (morphing from logistics suppliers into marketing operations) and supplying non-press products through the current press retailing network.

Building tech capability and investing in staff are two critical areas that appear to be slipping down the priority list.

What does it all mean?

The world of press distribution remains very tough – tougher than even just a year ago. In addition, the pace of change is accelerating. Yet there seems to be a greater acceptance of this and a more proactive and creative approach to managing the turbulence. Embracing the “pop-up” mentality is a clear theme: being able to operate at speed and gearing up to running tactical, one-off activities at the same time as developing more strategic areas which require investment and longer-term planning.

Yet there is a real concern about investment for the future. In the current climate of grinding cost control, building tech capability and investing in staff are two critical areas that appear to be slipping down the priority list.

There are also signs that the gap between Publishers and the other links in the supply chain is growing. In terms of what to do next, Publishers are focusing more than ever on digital and subscription models. Meanwhile, Wholesalers & Distributors are becoming more varied and radical in their diversification plans, but also more resigned to the ongoing reduction in the established retail universe. As a result, there are clear calls for all the links in the supply chain to work more closely together to drive changes that may be much more fundamental and radical than ever considered before.

A growing factor, and a new area tracked in the DCM itself, is the politics of N&M: increasing political interference in the production and distribution of content at the same time as a growing concern among politicians that quality journalism and content curation are essential elements of a free society, but that they are expensive activities that might need more State support. The public funding of private media is a complex and political subject in its own right, but increasingly important and one which would benefit from the coordinated contribution of the various links in the supply chain.

What is very clear in this year’s DCM is a real change in attitude where the priority now seems to be to identify and pursue a more limited number of growth opportunities rather than try to do too many things at once. Optimising the hotspots while avoiding the black holes.

There are clear calls for all the links in the supply chain to work more closely together to drive changes.

The Distripress Circulation Monitor is available to non-Distripress members, in digital or print formats, at a cost of 450 Swiss Francs. Contact Tracy Jones (Managing Director) / Email: tracy.jones@distripress.org / Tel: +44 7710 080591

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list, please register here.