In a statement released on 15 July, The Guardian said:

GMG achieved its primary financial goal, with an adjusted net operating cash outflow of £29.0m (2019: £28.1m), in line with the expected long-term returns from the Scott Trust Endowment Fund of £25-30m.

GMG had revenues of £223.5 million (2019: £224.5 million), with good growth in reader revenues offset by declines in advertising revenues and ongoing structural declines in newsstand, both of which were exacerbated in the final month of the year due to the effects of coronavirus.

GMG saw a record 1.5 billion unique browsers and 16.4 billion page views to its digital platforms during 2019/20, both up over 20% on the previous 12 months.

At 29 March 2020, the Guardian had over 790,000 recurring monthly supporters, and had received an additional 340,000 one-off contributions in the previous twelve months, taking total supporter numbers to over 1 million in this financial year.

The coronavirus pandemic has accelerated the existing structural pressures across the news media industry. GMG chief executive Annette Thomas and GNM editor-in-chief Katharine Viner have today announced to GMG employees a set of proposals to:

- ensure GMG is set up to continue to deliver the most impactful journalism on all platforms, with a particular emphasis on digital;

- set up the company’s operating model to enable long term sustainability and growth, focusing on the strong and growing relationship with readers; and

- reduce costs and reposition GMG’s business for the future.

Cost saving measures include proposals to reduce staff numbers by approximately 12% or 180 roles, with reductions expected in non-editorial and editorial departments.

Guardian Media Group chief executive Annette Thomas said: “GMG is well positioned for the future, after a second year of achieving its financial targets, with 56% digital revenues, and over one million paying supporters of the Guardian and the Observer’s journalism. Readers now account for 58% of GMG’s total revenues. However, we live in a time of great economic uncertainty, and there are many challenges ahead for the global news media sector.

“Today we have announced measures to align our operating model with our forward strategy, reduce costs and focus on the long term growth opportunity in our core business - impactful journalism and reader relationships - in order to promote a more sustainable future for the Guardian.”

Guardian Media Group chair Neil Berkett said: “The board is confident that our chief executive Annette Thomas, our editor-in-chief Katharine Viner and our management team and staff are well equipped to meet the significant challenges we face over the coming year. The plans announced today represent a strategic response to both the short and long-term factors we face, and will help reshape the business to achieve its long term goals.”

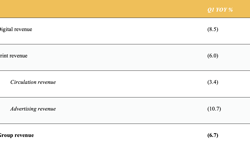

GMG’s statutory results for the 12 months to 29 March 2020 were as follows:

- Group revenues of £223.5 million (2019: £224.5 million), with good growth in reader revenues offset by declines in advertising revenues and ongoing structural declines in newsstand, both of which were exacerbated in the final month of the year due to the effects of coronavirus.

- Digital revenues of £125.9 million, up 0.5% on prior year (2019: £125.3 million). Digital revenues now make up 56% of revenues.

- Guardian News & Media (“GNM”) EBITDA before exceptional items of £(2.1) million (2019: £0.8 million).

- Group EBITDA loss before exceptional items was £9.3 million (2019: £3.7 million).

- Group loss of (£36.8m) reflected a reduction in the value of the Scott Trust endowment fund as a result of the financial impact of the covid-19 crisis (2019: £30.8m profit).

- Adjusted net operating cash outflow of £29.0m, compared to £28.1m in 2019. At this level, the Group’s cash requirements are financially sustainable, falling within the expected long-term annual returns of the Scott Trust Endowment Fund.

- The value of the Endowment fund and other cash holdings stands at £954 million, 6% lower than in prior year (2019: £1.014 billion).