The Subscriber Service Survey was developed by Wessenden Marketing who continue to run the whole project. It has grown from its start-point in 2007 as an internal Dovetail initiative with five of our own clients into an annual, industry-wide project. Now in its third year, it has input from PPA and involves 45 publishers with 440 of their titles, and polls the views of over 110,000 active magazine subscribers. This makes it the biggest co-operative publisher project of its kind in the UK and one of the largest customer service surveys in any industry. In addition to growing the scale of the survey this time, we really wanted to broaden its scope: the intention has been to identify the issues which really affect the all-important renewal levels that determine the profitability of the whole subscription model.

How can we measure renewal intentions?

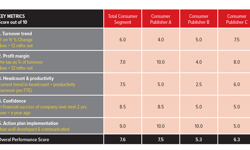

One of the key developments in this latest survey is a more sensitive measure of “renewal intention” as detailed in the table below.

“Renewal intention” clearly does not automatically translate into hard renewal rates – most of us do not get round to doing all the things that we intend to do! - but it is still a very good indicator of the strength of the bond between the subscriber and the magazine. The table illustrates some key points:

* Very few people (only around 5% of subscribers) actually make a conscious decision not to renew. Most are in various degrees of indecision with 75% genuinely intending to continue with their subscription (“definitely renew” + “probably renew”).

* The more uncertain they are about renewing, the more impact that the quality of the subscription service has on their likelihood of renewing.

* Renewal intentions vary massively from title to title, from a low of 41% in this year’s survey up to a high of 95%. Some warning bells are ringing for a number of publishers!

How many subscribers actually experience a problem?

At the very top level, 12% of subscribers have experienced some kind of service problem over the previous year. By far the most common complaint is the late delivery of the issue (although postal delivery standards have improved year-on-year), but the survey digs into more than thirty other elements of the subscription service from missing gifts and supplements through incorrect credit card deductions and on to the quality of the telephone staff. Those subscribers who have experienced a problem are less likely to renew (by a twelve percentage point margin) as the table below demonstrates. So, the impact of getting the service right first time is very clear and very measurable.

Let us dig a little deeper into these figures. Of the 12% who have experienced a problem, only 63% actually report it or complain about it. Of those who do complain, their experience of customer service can be very varied. For those who were “very satisfied” with the way their issue was handled, their renewal intention is a very high 84%, supporting the old adage that your happiest customers are actually those who experience a problem which you solve for them. For those who were “very dissatisfied” with the problem-handling, renewal intentions plunge to only 27%. To put this into context, the majority of subscribers are satisfied with the quality of the problem-handling, but the impact of getting it wrong is massive.

Can we measure the impact of improved customer service?

We have enough data from the survey about renewal intentions in different situations to model a few scenarios...

* If we could engineer the perfect delivery service and eradicate all late deliveries reducing those 12% of subscribers who have experienced a service problem to zero, this would improve the renewal intention from its base 75.1% to 76.6%, a rise of 1.5% points.

* If we left service problems as they are at their current levels and created the perfect problem resolution process, this would boost renewal intentions by 1.4% points to 76.5%. If, at the same time, we could get everyone who had a problem to actually complain about it and enter our problem resolution system, we could push renewal intentions up to 77.5% (+2.4% points).

And so on... The broad conclusion of these kinds of “what-ifs” is that to leap from where we are now to perfection would yield only modest improvements in retention rates and might be quite expensive to deliver. My guess is that most publishers are somewhere close to the optimum trade-off of service against cost. Service enhancements could and should always be made, but there needs to be a rigorous cost / benefit analysis beforehand. There is no room for complacency, but we also have to be pragmatic about the cost of perfection and this survey provides some of the tools to make that assessment.

What are the key pressure points?

The chart below shows the core customer journey with key contact points and issues along the way. They are all covered in the Subscriber Service Survey and we can place a renewal intention against each area so that their impact on the subscription model can be measured.

1. Pre-subscription contact

The survey shows that 76% of active subscribers had been buying the magazine from retail before they subscribed to it, with an average retail purchasing frequency of 7.5 issues out of 12 for a monthly magazine. Interestingly, it does not seem to make much difference to renewal intentions whether they had been buying it before or not, or for how long they had been buying it. What does make a massive difference is how often they had been buying it: high-frequency retail buyers morph happily and easily into high-renewing subscribers.

2. Subscription start-up

How easy it is to sign-up appears to colour the consumer’s whole view of the subscription service. How they pay is largely irrelevant. Direct debit locks subscribers in because of the mechanism, but they are actually no more loyal or committed to the magazine than credit card or cheque payers. Predictably, the reason why they subscribed in the first place (price discount, free gift, added value or service) is massively important with a 31 percentage point difference in renewal intention depending on the initial motivation to buy the subscription. So, the subscription model employed by a magazine has predictable renewal levels already built into it.

3. Subscription service

This is the core of the whole survey with the overall service quality having by far the biggest impact on renewal intentions. Also important is the speed of the first issue delivery – an area that seems to be growing in importance, presumably as internet-ordering generally becomes faster and easier. The length of time subscribing is another key factor. An old subscription adage is that “the longer they subscribe, the more likely they are to renew.” Yet what the survey shows is just how sensitive subscribers are in the “nursery period”, under six months into the subscription, where great focus needs to be given to bind these “green” subscribers in. Special treatment is a fundamental measure. Only 33% of active subscribers agree with the statement that “subscribing makes me feel that I get special treatment.” Those who agree strongly have very high renewal intentions at 90%. Those who disagree strongly drop to only 49%. Delivering that sense of “special treatment” lies at the core of the whole subscription experience and is clearly something that most publishers are failing to do.

4. Subscription renewal

While 90% of subscribers feel that the initial subscription sign-up process is “simple and user-friendly”, the figure falls to 75% for the ease of the renewal process. Renewing is not difficult, but it is not as slick and streamlined as it could be. The relevance and timing of the renewal efforts register solid scores with 84% agreeing that the level of communication is about right. The whole area of renewal pricing is very interesting. Only 25% of subscribers feel that they get better prices and offers when they renew in comparison to first-time subscribers, so there is a very high awareness that magazines usually penalise loyalty. This awareness of price does impact significantly on renewal intentions, as would be expected, but not as much as the ease of renewing. This emphasises the point that the whole mechanics of renewing are critical and perhaps need more focus.

How is the survey changing what we do?

The Subscriber Service Survey is focusing our minds on what is really important in the subscription service and the practical actions that can be taken to improve it. From a publisher perspective, these include:

* Changing mailing schedules to accelerate the speed of the delivery

* Altering packaging materials to reduce “damaged in the post” complaints.

* Using digital editions to close the first issue delivery gap.

* Promoting the self-service website area where consumers can manage their own subscriptions. Those who know about them seem to really like them, with 95% satisfaction levels and with renewal intentions being higher among website users, than those who get in contact via email, letter or phone. However, general consumer awareness of these sites still seems to be low, with 56% awareness levels, although these are edging up year-on-year.

From a bureau perspective, we have been doing things such as:

* Investing more in those contact areas where it is most needed, such as email response to queries.

* Delegating more responsibility to call centre staff so that they are more empowered and can make on-the-spot decisions.

So what does it all mean?

The survey shows that the magazine industry is getting better at looking after its subscribers. The number of service hitches is generally down in most areas. The satisfaction levels with how we handle those problems when they do arise are increasing. Yet the survey also suggests that consumers want faster customer service: they like online self-service areas; they notice slow first issue delivery more than they used to. Customer service surveys from other industries highlight that consumer expectations of the levels of customer service are rising year-on-year, often driven by online etailers such as Amazon who are setting new standards of speed and flexibility.

The whole project highlights that there are key pressure points in the customer journey where we need to become a bit smarter about how we look after the reader. At the core of the whole process is customer insight – understanding why an individual reader has bothered to subscribe in the first place and then meeting their expectations efficiently and cost-effectively. If we fail to do that, then as an industry, we shall be left behind in the customer-driven world that recession and the internet together are shaping.

For more information about the Subscriber Service Survey, please contact Ranj Lall at Dovetail or Jim Bilton at Wessenden Marketing.

ranj.lall@dovetailservices.com / 01795 414510

jim@wessenden.com / 01483 421690