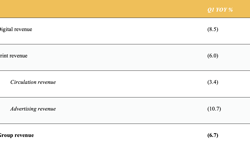

The statement read: “At our half year results announcement on 28 August 2009 we reported that total advertising revenues for the first 26 weeks of the year were down by 32.7% on the equivalent period in the prior year, and that the trend had improved over the first 8 weeks of the second half and the rate of decline had slowed to 26.1%. This trend has continued with the last 10 weeks only down by 19.1% such that the first 18 weeks of the second half of the year have seen a total advertising decline of 22.1%. The greater stability in advertising revenues we referred to in the half year announcement has continued with the average weekly advertising revenues in September and October being at the same level as in May and June, with improvements in the property market offsetting a continued decline in recruitment related revenues.

In addition to the significant cost reductions made by the Group in the second half of 2008 and the first half of 2009, we expect further progress to be made with a year on year reduction for the full year to be around £50m.

During the month of October, the Group announced the closure of two printing operations, one in Kilkenny, Republic of Ireland and the other in Edinburgh, Scotland. The impacted titles will be moved to either third parties or other group presses allowing increased colour, as well as cost reductions in 2010. There will be increased redundancy costs from those previously anticipated such that the cash exceptional costs for the year will be close to £12m. These closures will also result in a write-off totalling £20m being the book value of the presses on these sites.

The business continues to be cash generative, however, there is limited scope for debt reduction in the second half of the year. This is as a result of the £15m fees on the refinancing which were payable on signing, the exceptional costs noted above and the increased interest costs.

Given the greater stability in advertising revenues, combined with reducing declines in circulation revenues and continued progress with cost savings, the Group is confident of delivering an operating profit in line with current market expectations for 2009.”