Newspapers have been around for a while. The Daily Courant is considered to be the first regular daily newspaper in the UK and was first published on 11 March 1702 from rooms above the White Hart pub in Fleet Street, thus beginning a long and enthusiastic association between newspapers and the licensed trade.

The Courant started as a campaigning if somewhat myopic publication being "against the Ditch at Fleet Bridge". The daily newspaper has survived brilliantly, with a business model (revenue from a cover price and from advertisements) pretty much unchanged for over 300 years.

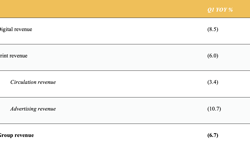

Revenue streams drying up

But change is in the air. National newspapers, as with all the traditional media like television and magazines, are losing advertising revenues because of the recession, but also as a result of the rise of the internet. Central to the problem is the loss of classified advertising revenue (“Rivers of Gold” as Rupert Murdoch reputedly and memorably observed). Newspapers’ share of the classified ad market has more than halved between 2000 and 2008 in a market now dominated by the web.

So what is to be done to address this substantial erosion of revenue to the web? Across the world, the print media are responding decisively with a range of strategies. The first is cost-cutting, refinancing and closures. For example, Condé Nast, the US-based publisher of magazines like the New Yorker and Vanity Fair, has just announced the closure of four magazines, including Gourmet which it had published for 70 years. In the UK, the Guardian Media Group is considering the future of the Observer, while the Irish-based owners of the Independent have refinanced with a €94 million rights issue and debt reduction programme of €350 million.

Some media groups are looking to the content side to boost their revenues. After years giving free content, publishers have concluded that free websites simply do not attract enough conventional space advertising to be sustainable. According to an Econsultancy study, Online Lead Generation 2009, online display advertising is in retreat, attracting only 6% of internet advertising spend in 2008 and showing a 7% fall since 2007. The Murdoch titles, including the Sunday Times, are therefore set to charge for content while Financial Times publisher Pearson is mulling a pay-per-article system. Stateside, the New York Times is considering charging for its content. Condé Nast is reportedly working with Time Warner's Time Inc, Hearst Corp and others to develop ways of making money from online magazines, charging customers to load magazine content on to mobile devices, such as electronic book readers.

A third way?

A third response plays to the undoubted strengths of the traditional media ... those of the power of their brands and the strength of the relationships that they enjoy with their readers ... and it is this opportunity that I discuss in the rest of this article.

At first inspection, the way that internet advertising is developing seems not to favour traditional media. Historically, the traditional media like newspapers have been able to charge high prices for advertisements because of the high barriers to competitive entry; it is simply not easy or cheap (or sometimes legally possible) to launch a competitor to the Guardian or to ITV. Now the media is open to everyone, and it is free. What did Cadbury pay to get 500,000 opens of their Drumming Gorilla ad in the first week of release - nothing! It was shown for free on YouTube - and also distributed and promoted virally for free.

So because the web is free, and open to all, anyone can set up a company and offer content and promotional services. Without the barriers to entry that exist in the traditional media, web-based service suppliers (such as affiliate networks which promote a client’s products on a range of partner websites) have proliferated so that clients have an abundance of choice. As far as web advertising is concerned, power has passed to the client who is able to call the shots. Instead of paying for his web advertisement or web-derived sales leads by unit, the increasingly savvy client is paying for them by result. Eighty percent of affiliate networks today are therefore remunerated through revenue sharing or cost per sale (CPS) models. In today’s über-competitive supplier market, the client can now pay when a result has been achieved - like a sale made or a test drive taken – sharing or transferring the risk from the client to the supplier.

Brand strength

Why is this good for newspapers? Newspapers as a medium are not going to disappear and neither is their advertising but they are being challenged by the web and they are seeking a substantial and serious ‘third revenue stream’ to replace the revenues they have lost. In some sectors, particularly financial services and automotive, sales leads and payment-by-results could generate an attractively large ‘third-revenue’ stream that newspapers seek to supplement their businesses. For example, an insurance policy sold can generate several hundreds of pounds in commission and a test drive taken yield fifty pounds. National newspapers in particular are in a powerful position to generate sales leads from their various media and to sell those leads (to advertising budget-holders) or, after adding value to those leads, as payment for results. Those with big brands will do especially well, as entry to the web may be free, but the credibility of most of new entrants low. Those companies which are known and respected will win the trust - and the data - of consumers. Brands do not get much bigger than national newspaper brands, like the iconic Times which is over 200 years old and known worldwide.

Early success at the Telegraph

The nationals have already taken steps to develop this third revenue stream and the building blocks have already been put in place. Ever since newspapers began, they have filled surplus ad space with reader offers paid for by results. By the mid 1990s, (co-led by Paul Hayes, now News International’s MD Commercial) the Telegraph newspapers were operating a powerful and pioneering ‘third revenue’ programme, at its height gathering millions of reader records from over 90 different sources (reader offers, fantasy football, electronic telegraph, and win-a-car promotions for example). Through the facilities of the Bank of Scotland, they offered the ‘Telegraph Loan’ to their database, winning £1m in annual commission that went straight to the bottom line. Their car insurance product attracted first year commission of £0.7m (and renewal commission thereafter). Today, the third revenue activities of the Telegraph titles produce around a third of the group’s profits.

National newspapers have therefore demonstrated that they are able to gather sales leads from readers in large numbers ... and, now that they have such extensive digital media, are able to gather these leads in real time. Their reach is impressive with titles like the Sun, for example, attracting a daily readership of nearly 8 million and titles like the Guardian (+11%) and the Times (+9%) putting on readership in 2008.

Moreover, since the mid 1990s national newspapers have developed a serious competence in direct marketing. (The Telegraph newspapers, for example, operate a subscription programme that today boasts some 325,000 subscribers and has required a solid commitment to data gathering, database, and direct mail - and a purpose built telemarketing centre.) Their ability to generate sales lead data, and their opportunity to add value to those leads through realtime webchat or near-real-time callbacks is therefore significant, with the potential to outperform other competing suppliers. As the Telegraph found, such contact does not damage the brand at all, provided that it is conducted openly. The principle has been proven; sales leads can be generated and payment-by-results welcomed (reader offer promotions have been an accepted feature of newspapers probably for 100 years). Now perhaps is the time to organise and to roll out?

NI initiative

This is exactly what News International (Times and Sun publisher) is testing. In a press release published in May 2009, News International (NI) announced that it was “to test the revenue potential of the leads generated by NI’s websites.” The release continued, “NI Commercial (is seeking) to build deeper relationships with its commercial customers by offering innovative ways to tap into the NI audience to generate response and improve cost of sale. With its iconic brands, NI is in a position to address the fast growing sales leads marketplace and to explore risk-sharing relationships.”

David German, NI’s director of classified, observed, “News International’s power brands attract unprecedented customer interaction. (We) will gather information about (customers’) immediate purchase intentions and introduce sellers to buyers through innovative solutions.”

NI is now testing risk-sharing deals with selected clients funded mainly through results. The prize for success is attractive. Newspapers can compete powerfully in a new digital marketplace and attract high margin business. They can use their rapidly advancing skills in direct marketing, honed by years of subscription management, to add value to sales leads and so maximise these margins. Newspapers can become enmeshed in their clients’ business, by becoming an important source of new sales to them. And, above all, as they receive remuneration in commissions and as part of the cost-of-sale they can tap a large new source of revenue outside advertising budgets, which are so recession prone at the moment.

So newspapers are adapting to change. In addition to their traditional offers of content and space, they are exploring the development of true partnerships with their clients, sharing the brand and sharing the risk. In an industry known for its often aggressive negotiations over ad pricing, this development will require some cultural change. But the prize is significant and is there to be grasped.