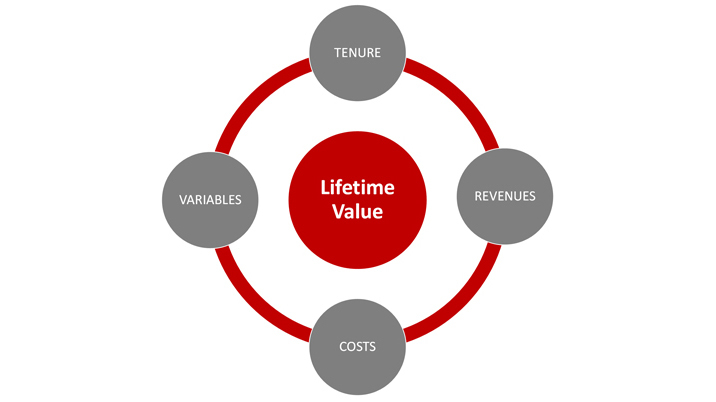

The concept of Lifetime Value sits at the core of any subscription model. It simply links revenues and costs over a predicted time period to produce a bottom-line assessment of value. Yet there are many different definitions of the components that go into the calculations – comparing “apples with apples” is a real challenge, even within different parts of the same organisation. There are also several ways that LTV can be used.

The 4 basic LTV building blocks:

LTV BLOCK 1: TENURE / LIFE EXPECTANCY

Subscriber churn is the most commonly used LTV measurement – the “hero metric” which can determine the valuation of a whole company.

At its simplest, it is the percentage of subscribers who discontinue their subscription within a specific time period, most commonly a month or a year. In some companies, typically in newspapers and magazines, churn is expressed positively as a “retention rate” rather than the more negative “attrition rate” which is the norm in streaming services.

Yet beneath that simple concept, there are a number of ways of calculating the actual maths. The most common variant is to mix in new subscribers gained during the period with lapsed subscribers to create a net growth figure. There are also more complex calculations including “churn probability” (the likelihood of any subscriber lapsing in a period) or “customer days” (the number of days in a period that a subscriber has an active subscription).

LTV BLOCK 2: REVENUES

Average Revenue per User (ARPU) is another key LTV metric that is deceptively simple to define, but more challenging to measure accurately. Care must also be taken to define for what period the ARPU figures refer to – month, year or lifetime – and to recognise that it is a gross figure (ie. before costs to generate and support that revenue are allocated).

In most business models, ARPU has three potential elements to it:

- Consumer payments for the core content or service (eg. an ongoing subscription)

- Additional consumer payments during the service lifetime for add-on purchases (eg. live events, experiences, ecommerce, in-app enhancements in video games, etc.)

- Attributed revenues (eg. advertising revenues generated from non-paying registrants or freemium users)

So, for example, for Spotify, the current average ARPU per month for paying Premium subscribers is £3.64. By contrast, free access users generate £1.23 per month in ad revenues. In addition, the company is generating additional revenue from podcast sales and merchandising purchases.

As with churn figures, most companies quote only top-level, blended averages, which conceal massive differences from cohort to cohort.

LTV BLOCK 3: COSTS

The key to LTV is to allocate costs to the gross revenues in order to assess bottom-line profitability. There are two core elements to this:

- The upfront, one-off cost of acquiring a new customer. This is referred to by a number of terms (eg. CPA, CAC, etc) which differ as to what precisely they are referring to – acquiring a free registrant as opposed to a paying customer, converting a free registrant to a paying subscriber… etc. This analysis can be undertaken as a top-level assessment or as a bottom-up review of channel and campaign effectiveness.

- The ongoing costs of servicing each subscriber. This ranges across content creation, content delivery, customer service, tech and UX investment.

LTV BLOCK 4: FUTURE VARIABLES

Every LTV model must take account of potential upsides (future prices rises, additional revenues, etc) and downsides (inflation and interest rates, competitive factors, regulatory intervention, etc). All of these future variables affect both the detailed revenue and cost calculations as well as the strategic direction of the company.

What is clear is that in the wider Entertainment & Media (E&M) market, the relative importance of each of the four building blocks is shifting. This is due in part to changing market conditions, but in addition, a number of companies are deliberately changing their own narratives, mainly for external investors. This means tweaking the building blocks. It is also leading to the growing importance of softer metrics such as customer engagement, based on deeper and deeper insights. As part of this shifting landscape, “Hero Metrics” , notably churn, are becoming increasingly dangerous, simplistic and inflexible ways to track and assess a business, when the real whirlpool world of E&M is becoming more complex and fast-moving.

LTV for everyone

LTV tends to make most people’s eyes glaze over, long considered to be the province of a spreadsheet nerd in the subscription department. Senior management often do not have the time or patience to unpick the complicated factors that go into LTV – they want quick answers to their simple questions. Yet a new report from Media Business International and Wessenden details how other E&M sectors are using LTV in much more sophisticated ways than the publishing business. And a free download of a Readly Roundtable details the more day-to-day issues of real-world LTV usage in publishing companies.

The bottom-line is that LTV is for everyone and everything.

LTV for Everything: the 6 dimensions of LTV

- Customer LTV (CLTV) is the most common application in publishing: maximising the profit from a defined audience of users.

- Product LTV (PLTV): assessing the value and strength of individual brands and services.

- Promotional LTV (PromLTV): assessing channels & specific campaigns from the bottom up.

- Content / inventory LTV (ILTV): based on a clear understanding of what customers want and what value they put on the content, an assessment of what it costs both to create and deliver that content – a massive issue in music and video streaming.

- Top-level company LTV (CoLTV): profitability across a portfolio of brands and products & services. This drives company EBIDTA.

- Employee LTV (ELTV): using the same principles to ensure that the “people inventory” is managed and maximised, for everyone’s benefit (we looked at this in more detail in the last issue of InPublishing).

In the wider Entertainment & Media market, the relative importance of each of the four building blocks is shifting.

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list, please register here.