‘Connections’ is the name of a programme of insight and research from DistriPress, which ran through 2021. This included virtual forums, themed roundtables, a regular newsletter and two major reports, written by Wessenden Marketing.

The first report in August 2021, Reconnecting the World of Distribution, was a case-study driven update, as the industry continued to restructure and reconnect. It looked in on an industry under pressure, but tackling its challenges with creativity and positivity – revisiting old plans, experimenting with new activities, whilst understanding and managing the legacy operations that still have life left in them. Its key conclusions were:

- There is a recovery on the way. It may not be totally clear how fast the recovery will be – and there will be major differences from country to country – but a recovery is definitely in progress.

- Moving from crisis management to planned & proactive action. The immediate fire-fighting activity has not disappeared, and the “new world” is still taking shape, but the emphasis has shifted into more planned activity in a new landscape.

- Growing optimism & “can-do”. The feeling is not universal, but there is definitely more optimism about the future and a readiness to try new things in new ways.

- The resilience of print. Print, especially premium print products, still forms a core platform for both publishers and consumers.

- Building on existing assets & relationships. The pandemic has highlighted the many things that the Newspaper & Magazine (N&M) supply chain is very good at – something that is often underestimated. The assets can be physical (eg. warehousing space, fleets of vans) or based on knowledge, skills, tech platforms or simply contacts. Yet leveraging all these assets must be based on a deeper understanding of publisher clients, retail customers, supply chain partners and end consumers. Collaboration, and sometimes unlikely partnerships, lie at the core of the recovery process.

- Revisiting old plans. Many of the case studies detailed in the report are not new developments. A number are based on revisiting what has been tried in the past, but which may work now with digital tools, a more collaborative approach, a revised business model and a more streamlined organisation.

- The growing digital dimension. Social media marketing, digital edition distribution, automated and digital comms up and down the supply chain – these are all examples of how wide-ranging the term “digital” is. It is a threat, an enabler and a challenge at the same time.

- The growing D2C dimension. Getting closer to the consumer is a priority for everyone involved in N&M. Understanding them, communicating with and marketing to them, delivering to them (both physical and digital products and services) and collecting product from them in reverse logistics processes – these are all different dimensions of D2C and present another set of challenges and opportunities.

- Thinking small & acting fast. There are real dangers in over-engineering. It slows down execution and it can increase the financial risks. Yet there still needs to be a long-term and holistic approach, as there are no quick and easy financial wins. Operating at speed and constantly tweaking and adjusting are central to many of the insights in the report.

- New items on the agenda. Creating the future workplace; sustainability and diversity; growing political interference in N&M content and distribution; the need for flexible tech stacks and platforms – these are all growing issues coming up the agenda of every organisation in the DistriPress membership.

- The future remains challenging, but is opening up. There will be more consolidation and company closures along the way, but clearing out the competition is part of opening up the future. Being more open-minded and collaborative, thinking more laterally, questioning every assumption, yet holding on to what works currently – these are all the prerequisites for a future that is opening up and coming back on-stream.

Collaboration, and sometimes unlikely partnerships, lie at the core of the recovery process.

The second report, published in December, Connecting Tomorrow’s World of Media, takes a more publisher and consumer-orientated view, looking at the bigger picture and to the longer-term future. It is also built around the DistriPress Member Survey (DMS 2021), which contains the views of 92 DistriPress members from 47 countries.

This report explored five key areas:

1. The macro context: are Newspapers & Magazines getting left behind in a fragmenting world?

The global economy is coming back on-stream, but at very different rates from country to country. The world may be facing common challenges, but it is also fragmenting in how it is responding and performing. This fragmentation is also reflected in the trends for N&M. Combined together, they represent a major US$156bn business in the growing Entertainment & Media (E&M) industry, ahead of Music, Video, Books and Cinema.

There is growing optimism and confidence from within the N&M sector itself, which is still driven by its ongoing creativity and launch activity.

2. The complex consumer: is the end consumer just too difficult to pin down or even define?

If the world is fragmenting in its financial performance, then the consumer of E&M products around the world is becoming more demanding and more difficult to define in traditional demographic groups.

The connected consumer is hard-wired into a digital world. They are also increasingly fickle and demanding, with pressure on their time and money. The low-friction consumer wants to choose, buy and consume as easily and as quickly as possible. The ethical consumer has real concerns about the social and environmental impact of their behaviours and spend. The home-based consumer is still in the process of rethinking their whole lifestyle and how, where and why they spend their money. The individualised consumer wants to be treated as a completely unique person and to be dealt with on a one-to-one basis by every brand they deal with.

All these factors add up – and sometimes collide – to make for a very complex consumer marketplace.

3. The morphing publisher: is the publishing business simply falling apart?

Some of the most radical and far-reaching changes are taking place at the top of the supply chain amongst the content creators themselves.

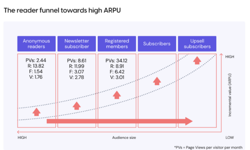

Publishers’ topline revenue streams continue to shift: from advertising to content; from print to digital; from retail to subscriptions; from volume to value.

Publishers’ underlying business models are also shifting just as rapidly and as profoundly, with key themes being diversification, getting closer to the consumer and developing an international presence.

Yet there are five hot topics on publishers’ minds at the moment:

- Working smarter with more efficient processes

- Growing ecommerce revenues

- Constructing the tech platforms to enable growth

- Building a truly sustainable business

- Surfing the wave of Merger & Acquisition activity

4. Shifting distribution channels: is physical retail being replaced by online?

The trend out of physical retail and into online shopping is well documented. So is the consumer desire to be multi-channel shoppers, wanting both physical and virtual threads to their purchasing and consumption.

This has some major implications for the retail channel itself, which is becoming more of an experiential showcase and a discovery and trial zone for a range of products and services. Physical retail can sit comfortably next to etail, rather than simply be seen as directly competing channels.

Zooming in on the trends in the physical retailing of N&M brands, there is no disguising the long-term decline in the number of retailers handling N&M or the pressure on space and range within these outlets. Yet Newspapers and Magazines add an extra dimension to the shopping experience and there are many examples of creativity and excellence in the retailing of N&M, which are picked up in the DistriPress Retailers to Watch initiative.

5. The flexing supply chain: is the N&M supply chain flexing to breaking point?

The N&M supply chain has had to adapt and flex rapidly in order to survive various lockdowns. At the top of the chain, publishers appear to be polarising between those who are engaging more deeply with the traditional supply chain and those who are cutting back. In addition, existing supply chain operators are doing two distinct things. They are building on existing relationships at the same time as actioning some permanent changes to supply chain processes.

A key link in the chain is the wholesaler / distributor. Their own business models are flexing as they manage their legacy activities, whilst introducing new revenue streams.

Running through all this change is the issue of sustainability, which is impacting profoundly on every link in the supply chain.

What does it all mean?

The conclusion of all this is that there is still great stress and uncertainty in the whole industry. Fragmentation; flexing business models; the changing workplace; getting closer to a complex consumer; sustainability – these are all big themes running through both DistriPress reports. Yet despite the challenges ahead, there is also the sense that the future is opening up for those with the confidence to try new things and to leverage their assets in new ways to create vibrant, growing and sustainable businesses.

The Top 6 Diversification Plays for Wholesalers & Distributors

- Morphing from a logistics factory into a marketing services agency. A long-term strategy for many, which has become an urgent necessity for most.

- Selling non-N&M product to current retail customers. This is not new, but many DistriPress members are revisiting and accelerating this whole area currently.

- Online magazine shops. Print and digital. Single copy and subscription – there are various permutations, but this is one way to get a slice of the digital action.

- Getting closer to retail with support packages, buying groups or even straight acquisition in a vertical integration strategy.

- Reaching the consumer at home in terms of marketing, but also physical deliveries.

- Creating a logistics consultancy, selling expertise and tech platforms in other territories and to other industries.

“You’ve got to be an optimist if you work in this industry. You can look at the numbers and think that we’re all working on a burning platform. But it’s still a big category and the pandemic has proved the value and appeal of print to the consumer. In our digital world, people are falling back in love with print magazines.” Tony Edwards, General Manager, ARE Direct

Publishers’ underlying business models are also shifting just as rapidly and as profoundly.

Non-members of DistriPress can buy both reports for a bundle price of CHF475, which includes on-demand access to the October DistriPress Forum. For details, contact: Lizanne Barber

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list, please register here.