That question lies at the core of the Media Futures project – an annual benchmarking survey among 83 UK companies across Consumer, B2B and News media. At the centre of all the revenue and productivity variables that the survey captures, change must be tracked just as much as any other metric. The fact is that change is not universally welcomed or accepted. Many companies are coming to change relatively recently; some, far too late. Two other factors are clear. Firstly, change is taking place faster in the larger companies. Secondly, there is a slight let-up in the pace of change at the moment, but massive change is anticipated just around the corner.

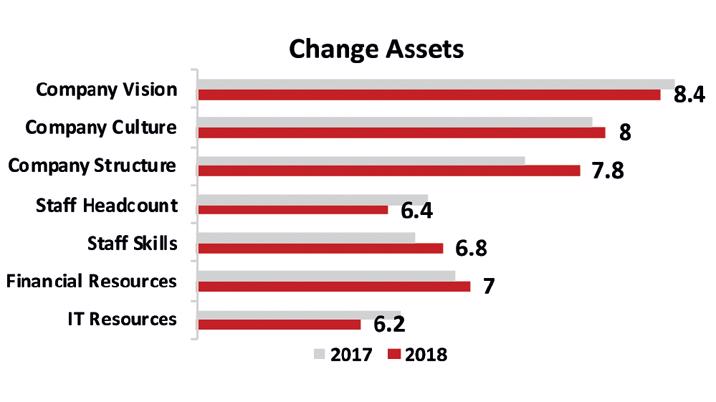

So, how well-equipped is the organisation to drive change and innovation? Here, the 83 benchmarking companies score themselves on a scale of 1 to 10 across seven “Change Asset” areas.

- Company Vision (8.4). Is there a clear and well-articulated vision of the kind of company we need to be? By far the highest score, but this is the easy bit. And it is slightly down on last year.

- A wide range of scores: many publishers are still struggling with the absolute basics.

- Vision is driven from the top of the organisation down (or not!): that vision is not just about the general direction of the company but must also set clear priorities.

- Company Culture (8.0). Is there an internal culture which encourages change and innovation? The scores start to dip as we move from strategy to real-life implementation. Yet this score is slightly up on last year. Is the vision generating an electricity that energises the whole company from the bottom up? The importance of a strong leadership team is also critical in creating and communicating the vision.

- Company Structure (7.8). Does the organisational structure encourage change and innovation? Here, the scores slip again. Yet this is well up on last year as many companies have already restructured.

- Breaking down the old silos of activity with flat structures and fast decision-making, informed by clear and regular internal comms. Open physical working spaces are part of this silo-busting: office occupancy rates range from a depressingly low 30% to a claustrophobic high of 95%.

- Moving from fixed job roles to projects in a matrix of relationships. Yet there is still a need for (1) accountability, (2) clear budget responsibility and (3) pools of expertise that can be accessed when required.

- Empowering staff to innovate and take risks. Yet is that manifested in real budget control and the authority to sign off expenditure?

- Gaining cooperation, cohesion, and communication across the organisation. Building the forums and disciplines to have time to talk to each other and share experience.

- Staff Headcount (6.4). Are there the required staff numbers to drive change?

- Staff churn increases as more new staff come in. Staff are harder to retain than to recruit and salary competition with other industries is becoming more of a challenge.

- Succession planning becomes more important in a churning staff pool.

- Staff Skills (6.8). Do our staff have the required knowledge, experience and skills to drive change? Another relatively low score, but significantly up on last year – making real progress in the task of “tooling up” the workforce. This area shows the widest range of scores from company to company. Each company’s experience is totally unique and there is often a complex legacy to be addressed.

- Financial Resources (7.0). Do we have the required financial resources to drive change? Scores edging up year-on-year. Yet a number of companies are concerned that, with currently soft revenues, they do not have the cash and basic financial staying power to reshape the organisation.

- Company size has a real impact on the scores. Smaller publishers feel that they are operating at a disadvantage to the bigger players who can (seemingly) afford to take a longer-term view in a digital world where scale appears to be increasingly important.

- The discipline of budget controls is forcing the ruthless prioritisation of activities, which is a key theme of the whole survey.

- IT Resources (6.2). Do we have the required IT resources and platforms in place to drive change? This remains the weakest area in most media companies and the scores are well down on the last survey. This remains the industry’s Achilles heel, but more of this in the next issue…

A big drop in scores and a year-on-year drop too. Headcount is a growing constraint – are there simply enough heads to get everything done? Behind that central question, there are two repeated issues…

Other important issues

Behind the seven core Change Assets that enable change, there are other important assets, such as brands, and external relationships with partners and suppliers, usually built up over a long period of time, and often under-valued.

So, what does all this mean? Firstly, ripping out cost is not the same as a proactive change strategy: in fact, real change is very resource-hungry (in terms of money, headspace and energy) and requires real investment. Secondly, while change has to be driven from the top down, it is actioned from the bottom up: resolving that tension lies at the core of the organisational structures and staff skills required for the brave new world. And to translate strategic thinking into action-orientated change.