When it comes to most trusted media brands, The Economist – widely lauded for its insight and analysis – is regularly up there with the best. In today’s world, however, it’s no longer enough to make content your king. User experience is an essential accelerator for future growth. Which is where The Economist Group’s Deep Bagchee comes in.

As the group’s first ever chief product officer since April 2020, Bagchee sits at the point where customer meets business, technology and content. His brief is to stitch together all four, and he jokingly likens himself and his product team to blue-helmeted UN peace-keepers.

“Product is at the intersection of technology, business and customer,” he observes. “In a media context, this is fascinating.” And for someone who joined the group after many years in broadcasting, in a publishing business, it is even more so.

Following an economics degree in Mumbai and a master’s in international journalism at Cardiff University, Bagchee worked as a TV correspondent and anchor in India before joining Bloomberg as a producer and then – after a stint in business development – CNBC in New York, where his last role was senior vice president, product & technology.

Now based in London, his focus at The Economist Group is on customer-centric digital experiences across all B2C and B2B activities. He is responsible for product development, product management and product design for both these sides of the business.

Product is at the intersection of technology, business and customer.

Product & technology

His role underlines the belief of the group’s management team – headed by Chief Executive Officer Lara Boro and President / Managing Director Bob Cohn, who took on their current roles in 2019 and 2020, respectively – that fulfilling their growth ambitions depends on investing in product and technology.

“The goal Lara has for us as a product team is to bring about a customer-centric mindset organisation-wide, and to do product development the way most modern companies do it,” he explains.

Previously, The Economist had experimented with many new formats, technologies and products.

It was a pioneer of digital briefing editions, for example, with The Economist Espresso. It was early into audio content, too, offering audio editions of its main weekly content and creating an impressive array of podcasts before it was fashionable to do so.

“But a lot of product activity was editorially-driven. There wasn’t a product team as one functional unit across the entire business – some product people sat in editorial, others on the commercial side,” he adds. “The thinking behind my role was to have someone at the top table accountable for it.”

Over time, The Economist has shifted. Once it was a weekly publication. Today, it is somewhere you can come any time to get smarter, Bagchee observes.

Yet its value proposition to users – differentiated content that provides a deeper understanding of the world, rather than ‘just’ breaking news – has stayed the same despite this shift. And moving forward, he says, however The Economist Group evolves its user experience and product portfolio in response to market changes, that value proposition will remain constant.

Creating a product framework

In his first year, Bagchee has overseen efforts to build understanding of product, product management and the value of a coherent product strategy.

A set of core product objectives – customer acquisition, for example, and customer retention – were agreed and then rolled out for all product teams and their respective cross-functional partners. A roadmap process was established, so all involved would agree priorities then work to quarterly plans.

With new systems and structures in place, attention then switched to empowering product teams.

“Our product teams had been focused on taking tasks from other people in the business – a product manager would be told to fix this or change that. So, we empowered our product, technology and project management people to work in squads, or mission-driven teams – focused on customer engagement, for example, or acquisitions,” he says.

Each team is cross-functional – including designers for creativity, product managers and technologists working side by side. There is a greater emphasis on accountability, too, with more people “owning” their own metrics. This has led to a shift from an output-driven to an outcome-driven culture.

One example of this in action is what’s been done around customer retention by one of the cross-functional product teams over the past twelve months. Informed by data, they came up with a retention plan with a number of components.

“We removed our introductory 12 issues for 12 pounds offers which, though it brought in a lot of people didn’t retain them well, and went up in price, replacing it with a simple 50% off quarter one proposition,” Bagchee explains.

Also, when Covid-19 hit, it acted quickly to overcome any short-term Covid-related print distribution issues by offering all new subscribers the option to subscribe to either print-and-digital or digital-only. Those already subscribing to print-only, meanwhile, had their subscriptions upgraded at their next renewal date – to either print-and-digital or digital-only.

Work was also done to “increase the cadence” of customer communications – especially during new subscribers’ onboarding journey. And a new raft of subscriber-only events was developed, including a Bill Gates webinar on Covid-19 and vaccines – all of which attracted an audience of tens of thousands.

According to latest ABCs, The Economist’s worldwide print and digital circulation was 1,583,955 (July - December 2020), of which print accounted for 709,153 and digital 874,802 – a 45:55 print:digital split.

As a result of the customer retention drive, Bagchee says, by the end of 2020, the number of subscribers engaging with The Economist’s digital content had increased by 50%. Meanwhile, the number of people who moved from a trial subscription to a full subscription during this period rose 20% year on year (all subscription packages now have digital included).

What we are trying to do is bring all these things into the core The Economist value proposition.

Enhancing the value proposition

“In the old days, there was more of a publisher / circulation type model, with different publishers for different publications,” he adds.

“What we are trying to do is bring all these things into the core The Economist value proposition – to say: let’s break down these walls, all these different products are all one thing. So, if you pay for The Economist subscription, you get all of these other things too as part of your bundle.”

Unfolding hand-in-hand with all this has been the creation of a single flagship website and single flagship app for The Economist subscribers.

“For too long, we’ve pointed people to different products in different places – our lifestyle magazine 1843, for example, lived on a separate website. There was a lot of content that wasn’t part of the core subscription bundle,” Bagchee continues.

“Now, we’ve brought all this subscriber content into our core user experience and paywall. And we’ve launched new newsletters for people who don’t always want to jump straight into our site but access content from their inbox to consume while on the move.”

One important priority for year two is increasing the product value proposition. This will involve doing more subscriber-only events and further elevating audio by improving the user experience to make audio content more accessible on the website and app.

There will also be further development of the group’s newsletter strategy – by evolving both new products and thinking around which are charged for and which are free, and production development around data and visual journalism.

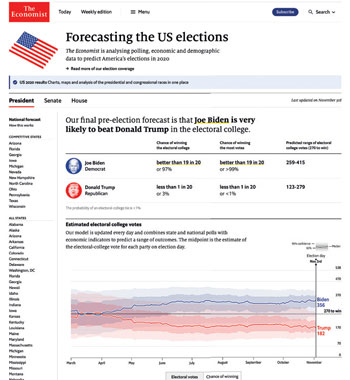

The latter will include building on products launched in the US to support The Economist’s coverage of the 2020 US Presidential Elections – a major story and business catalyst for the group last year. Bagchee identifies particular opportunity in evolving some of its election-inspired “explanatory journalism” products, such as its Presidential Election forecast model and tracker charting President Biden’s first 100 days.

Another priority is evolving customer experience using a recently introduced new technology platform known internally as the Future Customer Experience.

This platform now hosts all of The Economist’s digital-only customers for anything from taking out a subscription through to managing their account. Over the next few months, bundle customers (those subscribing to digital and print) will also be migrated onto it. It will also be used to host enhanced student subscription and gift subscription offerings.

TV & publishing: what lessons

One year into the world of publishing from his earlier career in broadcasting, Bagchee sees a number of lessons publishers and TV companies can learn from each other.

“For years, the TV industry was protected from the disruption print and newspaper and magazine publishing experienced,” he observes.

“Many US broadcasters had dual revenue streams – from cable operators and from advertisers. Until Netflix became a behemoth and TV companies realised they had to get into the direct to consumer game – something publishers have been grappling with for a long time.

“The Economist has had a subscription model for quite some time. For Time Warner with HBO Max, NBC Universal with Peacock and Disney with Disney+, this is much newer. And there is a lot for TV companies to learn when it comes to customer relationships, and acquisition, and retention.”

Looked at the other way, the big lesson for publishers is the need to invest, the power of differentiated content and the importance of patience.

“More traditional subscriptions businesses can see from large TV companies’ direct to consumer offerings the cost involved and the need to resource them sufficiently. Also clear from the number of TV companies now taking programming off Netflix to put on their own platforms is the importance of differentiated content and a strong library,” Bagchee adds.

“For publishers, the question has to be: what content do you have that is unique and not commoditised and how can you use what you have to provide your customers with something that is really different?

“Finally, for publishers and TV companies, it’s a long game. It’s taken Netflix 20-plus years to be what it is today. You’ve got to invest, then you’ve got to wait for that investment to pay off. Then when you get to the other side, you will know if your business is sustainable.”

You’ve got to invest, then you’ve got to wait for that investment to pay off.

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list, please register here.