On initial sales made through iTunes, acceding to Apple’s 30% take can be written off as a cost of new-business generation. After all, publishers still use sub agents (although, now that advertising revenue levels no longer support inflated rate bases, they’re minimising use of agents in favour of direct-to-publisher sources). However, there’s a critical difference: With sub agents, publishers pay a remit on acquisition, but own that name thereafter. Meaning no middleman cut on renewals — by far their most profitable sub revenue channel — or on other content / product sales.

But Apple isn’t playing by the magazine industry’s traditional game rules. Apple’s terms: We own the customer data, and publishers continue to pay 30% on every sale — take it or leave it.

Bonnier’s U-Turn

My last column noted that Bonnier Corp was to be the first magazine publisher to offer app-based iPad subs, as opposed to just single issues, starting in June with apps for two titles — and that other publishers were hot on Bonnier’s heels.

Well, that was the plan... but Bonnier’s announcement turned out to be a tad premature. Bonnier did develop the app — checking in with Apple and getting verbal approvals along the way, sources tell me. But once submitted, Apple gave the app a thumbs-down. Soon after, Folio: reported that Sports Illustrated’s sub-based iPad app was also rejected, even though Time Inc’s model (offering free trials in year one, then having new subscribers buy issues a month at a time) was similar to that of Apple-approved sub offers by non-magazine properties that appear to be direct-billed to the marketers. The Wall Street Journal is selling an iPad app for $3.99 per week on its own online storefront, for example - although its specific terms with Apple haven’t leaked, to my knowledge.

Nor is Apple alone. Amazon is selling Kindle-platform, credit-card based magazine / newspaper subs on a per-week or per-month, auto-renew basis (eg, $1.25 per month for Reader’s Digest and $2.99 per week for Time), and retaining customer relationship ownership. Here’s how Amazon describes its publisher relationship to online purchasers: “We will share the name, billing address, and order information associated with your newspaper or magazine purchase with the publisher, who is under obligation to keep that information confidential. We will not share your credit card information or email address. Publishers may use this information for market analysis and for other purposes and we or they may share this information with a circulation-auditing organisation.” Given the number of magazine apps offered on Amazon, its sub terms presumably are somehow more acceptable to publishers than Apple’s.

Meanwhile, on the Apple front, publishers continue to sell single copies — at prices reflecting Apple’s cut and their need to preserve some kind of margin. This has resulted in a barrage of consumer online postings on iTunes and magazine sites expressing outrage about being asked to pay $5 or so for a single, digitally-based issue and pleading for lower-cost subscription options. Hearst (admitting its unhappiness about this) told MediaMemo/All Things Digital blogger Peter Kafka that when it launches iPad apps for Esquire and Oprah later this year, issues will be bundled as a one-time purchase, with iTunes taking 30% and Apple retaining the billing data.

Meanwhile ... over at NIM

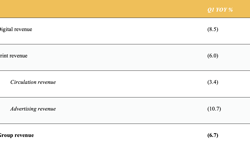

However, publishers aren’t taking all of this lying down. The stakes: An analysis conducted for Next Issue Media (NIM), the digital consortium formed by several major magazine publishers (and WSJ owner News Corp), estimated potential magazine / newspaper industry revenue from digital content platforms at $3 billion by 2014 ($1.3 billion in incremental revenue, after print cannibalisation is accounted for).

It’s no secret that developing a proprietary apps digital storefront — offering platforms in no way limited to iPad, Kindle or even e-tablet devices (smartphones are a huge opportunity) — is NIM’s raison d’être. And while the industry is being unusually tight-lipped, fulfilment bureaus are working on enabling that storefront, and it would appear that the open-source HTML5 platform would enable offering versions that are compatible across devices (including iPad). But while direct-to-publisher sales are the overall objective, the industry is (so far, anyway) taking pains not to insinuate crossing swords with Apple.

In late July, Kafka quoted this statement from NIM participant Time Inc: “We are working with a number of partners and potential partners and hope to offer in-app subscriptions some time later this year.” Apple provided this comment: “We have two platforms that we support for apps of all types, including magazines: HTML5 provides an open platform for developers to create and distribute whatever they want, and the App Store, which is a curated platform offering customers the largest offering of apps for any mobile device, with over 225,000 apps and 5 billion downloads.” (Gee, think there’s a message there about what publishers could lose if they do try to cross Apple?)

For now, we must wait to see how the specifics pan out once NIM is ready to launch its e-commerce app solution.