Q: How are publishers refining their paywall strategies?

A:

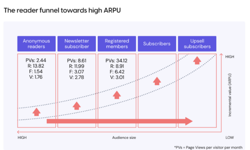

The rapid growth of paywalls has led to more sophisticated practices. A recent survey showed that the most common access model is “freemium” (specific articles are designated as ‘free access’ or ‘paid-only’) at 45%, followed by digital replicas of print pubs at 32%, metered at 11% (and declining) and the "hard" all-paid model at 8%. Other variations are being tried but the numbers so far are tiny.Two significant trends are emerging. First, publishers are further restricting both the number of free articles and the timeframe allowed or are shifting completely to freemium models, as the Swiss newspaper Le Temps did recently. With this shift, marketing and editorial decide together what is “behind the wall” and what is available for free. Second, data is playing an increasing role in customising paywall strategies. Using AI to track behaviour such as reading habits and frequency of visits is a growing practice.

Q: What innovations are you seeing in the way publishers market their digital subscriptions?

A:

Besides paywall strategies getting more sophisticated, interesting marketing strategies are being tested. For one, special efforts are being made to reach youth and international markets. Youth is targeted in various ways, such as free access for students, supplying study material (like FT), special discounts (The Economist) or a reworked format (like Schibsted). The goal for the international sector is to broaden the market like The Guardian did by successfully evolving from a UK publication to a global one.A second strategy to reach new audiences is through audio. The model is not yet proven but France’s Le Monde is getting promising results. Finally, increasing interaction between editorial and subscription departments may be the most innovative strategy. For example, using a teaser marketing campaign to generate interest in a major investigative piece (like the 2018 Uber Eat investigation at Gazeta Wyborcza), or deciding together if an article is best used for attracting, converting or retaining subscribers. News Corp Australia has developed an impressive application – Verity – using AI to measure the effectiveness of this strategy.

Q: Is there anything publishers can do to grow their share of the ad revenue pot when faced with the market dominance of Google and Facebook?

A:

Publishing’s share of ad revenue declined further in 2018 while Google and Facebook continued to grow. A successful advertising model that will improve the economic picture of the industry is still being sought. Increasing paywalls may produce more revenue but also may reduce traffic. Meanwhile, with the demise of third-party cookies and more publishers requiring visitors to log in, there are new opportunities. Registration enables the storing of a reader’s journey across devices and that data is valuable in attracting advertisers. In several countries (France, Portugal, Germany, Finland …) a unique shared ID among publishers is being developed which may pave the road to more autonomy from the big platforms.Q: How do you expect publishers' 'voice assistant' strategies to evolve in 2020?

A:

There will certainly be more testing of voice assistants, but I don’t expect this to be the primary focus for now. Speaking of voice, publishers are only about a year into it through the podcast business and still learning. No strong viable model has been identified, and there is a lot of competition from other players (radio, streaming …) but it is a growing area.Q: How do you see the structure and shape of the publishing sector changing over the next few years?

A:

In less than twenty years, the value of the publishing market has been cut in half in many countries. Most, but not all, of the reduction is in advertising revenue and digital subscription growth has not been enough to make up for it. Therefore, we’ll continue to see major restructuring and downsizing in the industry and the disappearance of more publications and/or publishers. Over the last few years, digital players have enacted major layoffs (Buzzfeed, HuffPost and Mashable) and traditional publishers have been bought by investors from outside publishing. Sometimes, this offers an opportunity (look at the Washington Post, taken over by Jeff Bezos, for example) but often, it creates bigger challenges. Meanwhile, some native publishers are still growing through acquisitions, like the Flemish Mediahuis. In a few years, maybe the New York Times’ Mark Thomson’s forecast of an easier competitive landscape for those that survive will be reality.Q: What is the future of the print edition?

A:

Print is not dead or dying anytime soon – it still accounts for the biggest share of publishing income and profit. Some metrics show it takes seven digital subs to replace one print. Also, readers still place high value on print and offer less resistance to paying for it. Studies show other strengths over digital, such as more time spent reading print and higher retention of the material. Actually, in the short term, print is not threatened so much by digital growth – it can even coexist successfully – but rather by the upheaval in distribution. The newsstand business is collapsing in many countries and on the subscription side, all postal companies are seriously challenged with the drop in postal traffic volume. How will that continue to impact distribution, especially for magazines?Another challenge is that the print audience tends to be older. It isn’t known if today’s younger readers will pick up the print habit as they age.

About us

“We are the leader in world-class subscription and membership management software: Advantage and Members Advantage. Capabilities include marketing, sales, payments, and customer relationship software for publishers, membership associations and information providers.”

Web: www.advantagecs.com