As reported by Reach plc:

Revenue trends

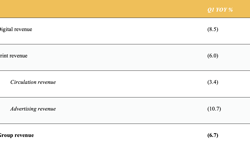

Group revenue in the period was down 13.1% with print revenue down 15.8%, while digital revenue grew by 4.7%. Having started the year well, with encouraging digital growth, the COVID-19 crisis began impacting the business from mid-March. Since that time the Group has seen declines in circulation sales, falls in print advertising revenue at a national and local level, reduced printing requirements from third parties, impacts from cancelled events and a reduction in digital yields due to lower advertising demand.

Despite this we have seen unprecedented demand for news and content across our digital titles, with 42 million online users in the UK in March, ensuring Reach retained its position as the 5th largest UK online property. April saw total page views of 1.7 billion (up 57%), average daily app users rose by 47% to 674,000, and our hyperlocal news platform InYourArea surpassed 650,000 registered users. This progress towards our key strategic objectives of increasing customer registrations and securing enhanced customer data and insight, provides strong foundations for future progress.

April represented a full month of impact from the lockdown and saw Group revenue fall by 30.5%, with print revenue down by 31.8% and digital revenue falling 22.5%, with higher page volumes not able to offset declines in advertising yields. While in some areas we have recently seen a stabilisation in trends, circulation remains significantly below pre-COVID-19 levels and advertising remains very challenging and uncertain, with regional advertising particularly impacted.

Key mitigating actions

On 6 April, we confirmed that a number cash conservation and cost reduction measures had already been introduced. Further to these actions we also announced additional measures including pay reductions, suspensions of all 2020 bonus schemes and furloughing of a number of colleagues, as well as the cancellation of the 2019 final dividend. These changes were successfully implemented shortly after the announcement. In addition, we began discussions with pension funds about a three-month deferral of monthly contributions which has now been agreed.

Balance sheet and liquidity

The Group continues to have access to sufficient liquidity. Net cash surplus as at the 26 April 2020 was £33.2 million reflecting the proactive steps taken to conserve cash. This represents a cash balance of £58.2 million less £25.0 million which has been drawn down from the Group's revolving credit facility of £65 million, which is available until December 2023. The business has a proven track record for disciplined cost control and strong cash management which will continue to be vital in the current uncertain trading environment.

Outlook

While revenue performance for the year is expected to be significantly impacted by the COVID-19 crisis, the cost mitigation measures introduced will partially protect profitability levels and cash generation. Given the continued uncertainty about the severity and length of the crisis, Reach continues to suspend guidance. We came into this crisis with a robust financial position and continue to run an efficient business.

Jim Mullen, Reach plc Chief Executive, commented: "Our priority in this crisis has been to ensure the health and safety of our colleagues and I would like to thank all of them for the positive way they have responded throughout this process. Our teams continue to focus on producing the award-winning journalism and content that is so valued by our customers at this critical time. We continue to build on our position as the UK's largest commercial national and regional news publisher. Our strategy is now even more relevant than before the crisis so we are accelerating plans to drive digital engagement and capture the customer insight and data that is so key. This will ensure a strong and sustainable future for Reach's trusted news brands."