Tech has always caused traditional publishers real problems. Their real expertise is in content creation and the major players have always gone through cycles of farming tech out and then pulling it back in-house. This approach has normally been driven by short-term cost and investment issues rather than any great strategic thinking.

Yet as “publishers” have morphed into multi-platform, multiple revenue stream “media companies”, it has become an absolute necessity to have a more joined-up tech strategy. The content creators may still outsource key elements of tech execution to external suppliers, but they actually need to know a lot more about what they are doing, which elements they need to buy in and how all the tech dots join up.

It has become an absolute necessity to have a more joined-up tech strategy.

Tracking media tech

Each year, mediafutures polls the industry across a broad range of metrics and benchmarks. One key area is the toolbox of Change Assets, which allow companies to surf the tidal wave of change: “How well-equipped is your organisation to drive change & innovation?” (1 to 10 self-assessment scores). Tech (IT resources & platforms) consistently comes bottom in the listing of seven key factors. It is the long-term Achilles heel of media companies.

In 2019, there had been a real sense of “getting there” at last with tech developments.

The scores were low, but they were rising. However, in the latest survey, this trend has stalled and the scores have levelled off. There is still a problem.

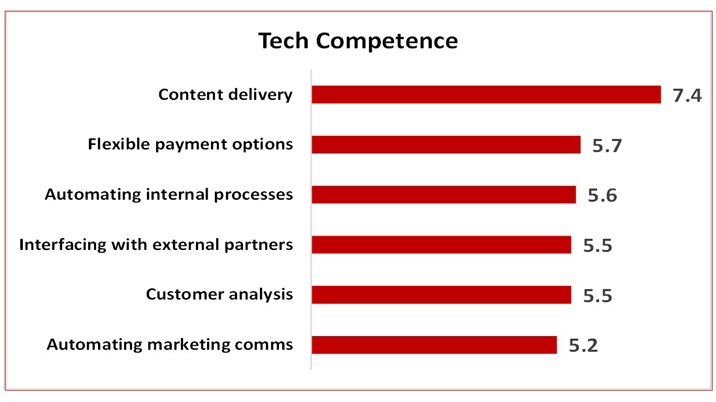

Tech competence varies widely from area to area

The same 1 to 10 scoring system was used when drilling down into more detail.

• Content delivery (7.4): By far the highest score and also showing a strong year-on-year increase, this is the core application of tech in publishing. Yet, if you can’t get this right, then you may as well give up. Also, there is a growing concern about the value, usability and sophistication of the content delivery systems, when set in a broader media and entertainment marketplace which is accelerating in its tech capabilities: Netflix, Amazon, Apple and Spotify continue to set the standard.

While virtual reality and augmented reality still catch the headlines, these have pretty limited usage in most media organisations. It is video and audio where the big changes are taking place, as text-based delivery comes under increasing pressure. Of the two, audio is probably the more far-reaching. It ranges from the revitalisation of the good old podcast at one extreme through to smart speakers and digital assistants (Alexa, Siri, Cortana and the like) at the other. The long-term impact of the shift into voice and audio is still difficult to forecast, but it will not just affect how users absorb content, but it will also hit search and ecommerce. At the same time, old activities such as the trusty enewsletter are making something of a comeback to sit alongside the newer stuff like chatbots. Yet, lying behind every content delivery mechanism is the need to tailor the whole experience for individual users – personalisation is the key driver of every tech development in content. And that means automation and AI.

Personalisation is the key driver of every tech development in content.

Where the industry is getting better

Comparing the 2020 scores with 2019 shows where certain areas are improving…

• Wide & flexible range of payment options (5.7): An area rapidly growing in importance. Low friction payment is at the core of the whole Amazon service, both online and in physical bricks-and-mortar outlets. This is setting new levels of UX expectations among end-users in both consumer and B2B environments.

• Automating internal processes (5.6): Being able to automate as much as possible is central to (1) delivering more efficiency and productivity and (2) improving the sophisticated delivery of solutions tailored to specific situations and audiences.

• Customer analysis (5.5): Being able to analyse users’ transactions and behaviours is critical to the media future, both to target publishers’ own activities and to generate insight services for advertisers and partners as a revenue source in its own right. Whilst some progress is being made, this is generally felt to be well behind the pace that is required, with a number of companies feeling that they have only just started to scratch the surface.

Where the industry is slipping back

The 2020 scores have dropped year-on-year in two areas…

• Interfacing with external partners (5.5): An increasingly important area, as partnerships and collaborative promotions increase, companies need to be able to swap data quickly and to fuse distinct information pools together. This has become just as important as trying to create a single, self-owned data warehouse – for many organisations still just a pipedream.

• Automating marketing comms (5.2): Being able to tailor marketing communications to end-users is another key application (the personalisation issue again), but one which lags behind all the other areas and which has slipped back year-on-year.

Being able to tailor marketing communications to end-users is another key application, but one which lags behind all the other areas.

USA ahead of Europe in most tech areas

For the first time, we are able to dive into the US market with the full mediafutures survey having been undertaken among 154 US publishers. In almost every area (payment tech is the one exception), the USA industry has higher scores. The lead stretches in two specific areas: marcomms and interfacing with external partners – the two areas which saw a year-on-year drop in competence among European media companies.

Rising to the tech challenge as an industry

The mediafutures project highlights two key issues. Firstly, the range of tech competence varies massively from company to company, and from area to area within each company. Secondly, the European media industry is still finding the partnership culture difficult to accept and there is much more hesitation about outsourcing key tech functions than in the USA.

Rising to the tech challenge, however it is executed, is one of the biggest tasks for most media companies in 2021.

mediafutures is an annual benchmarking survey of the industry undertaken in partnership with InPublishing. It maps the key drivers and metrics that are transforming the shape and direction of the media business. This year, mediafutures has gone international with Colin Morrison’s Flashes & Flames and Access Intelligence in the USA as our two new partners.

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list, please register here.