To say that 2019 is turning out to be a tough, unpredictable and chaotic year is hardly a revelation. Yet beneath all the “sturm und drang”, there are longer-term trends at work in media in what is a complex and surprisingly robust industry.

Firstly, let’s put the media business into a broader context. PwC reckons that the total Entertainment & Media industry is currently turning over around £73bn per year and is growing at +5% year-on-year. Only three sectors are declining in 2019: Consumer Magazines (-6%), Newspapers (-4%) and Traditional TV & Home Video (-2%). By contrast, B2B is in solid growth (+1%) driven up by information products and live events. Yet taken together, Consumer Magazines, Newspapers and B2B form a massive £13bn chunk of the total E&M picture, dwarfing Music (£6bn), Consumer Books (£3bn) and Cinema (£2bn).

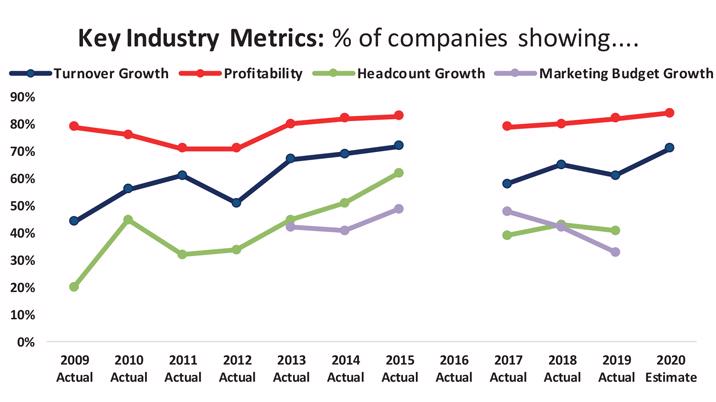

Now, let’s pick out four key metrics from the Media Futures survey, which are shown on the graph. They come with a health warning, as the 112 companies which have participated this year are, as ever, self-selecting. So, they are made up of the smarter and more proactive operators, which is reflected in their industry-beating financials.

1. Turnover growth.

This year, 61% of respondents claim to have a growing topline. This is slightly down on last year’s 65%, showing that this year is tough, but not nearly as bad as 2012 or 2017, when there were big dips. The underlying average rate of turnover growth is a strong +5% year-on-year, with B2B (+8%) outperforming Consumer Media (+3%) and News Media (flat). There is more optimism about 2020, with a clear uptick in what people are budgeting for next year.

2. Profitability.

A much bigger proportion of respondents (82%) claim to be profitable currently. The profit line is much less volatile and much stronger than turnover – the result of ongoing and grinding cost control – with a steady upward trend in recent years. Here, the underlying profit margins are running at a fairly steady 10%, which is also pretty consistent across every sector of the media business.

3. Headcount growth.

This is the metric which dived the most in 2017. It is now more stable, but is still weak. Currently, 41% of respondents are reporting an increase in their workforce numbers, with 48% holding steady and 11% reducing. An ongoing issue for the industry is simply having enough people to action the growing “to do” list – a repeated theme throughout the whole survey.

4. Marketing budget growth.

This metric is trending sharply down, showing a dropping spend on promotions, research and NPD. Currently, the marketing budget size is running at just under 6% of turnover, but this is predicted to drop again next year and is very varied from company to company and from sector to sector, with Consumer leading at 7%, B2B following at 6% and News lagging at under 3%. So, far from investing more heavily in our brands, the trend is actually the reverse – and worryingly so.

So, what does it all mean?

2019 is undoubtedly a tough year for topline revenues, but ongoing, tight cost control is edging profits up. There are growing differences from sector to sector – B2B is setting the pace with Consumer lagging behind and with News Media having another difficult year. There are also some warning signs. Are there enough people in the business to execute some very ambitious strategies? And is the industry underinvesting in terms of supporting and developing its brands? Yet, there is a real sense from many respondents that the organisation is being knocked into better shape for 2020. And when all is said and done, it is still a relatively robust and profitable industry with margins that many a start-up would kill for or will never achieve.

Taken together, Consumer Magazines, Newspapers and B2B form a massive £13bn chunk of the total E&M picture.

Media Futures is an annual benchmarking survey undertaken by Wessenden Marketing in partnership with InPublishing.

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list, please register here.