Taking the topline, industry-wide averages, the percentage of total company revenues coming from digital products and services is currently standing at 26%. The participating companies are budgeting for that figure to grow by +7% points to 33% in two years’ time – a rapid rate of change that has held steady over the last two years’ surveys. Yet dig a little deeper and some important differences start to show…

- News Media (a mix of national and regional brands) has the lowest digital share (8% now) with a slightly slower +6% point shift in two years.

- Consumer Media has a much higher 19% skew and is also shifting at +6%.

- Predictably, B2B has by far the highest digital dependence (33%) and the fastest shift (+7%).

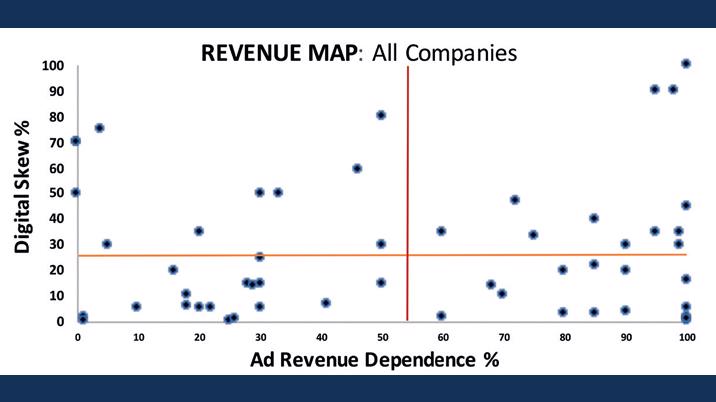

Drill down deeper to individual company level and the complexity of the media market becomes immediately apparent. The Revenue Map plots each company participating in the survey against the two dominant revenue variables of digital and advertising. The horizontal axis measures the dependence on advertiser revenues (average = 54%) as opposed to user / audience revenues – the further over to the right, the greater the reliance on ads. The vertical axis shows the dependence on digital revenues (average = 26% currently) – the higher up, the more digital the company.

- The top right quadrant is populated largely by smaller B2B companies, where there are a number of operations which are totally ad dependent.

- The bottom right is the “danger zone” (low digital + high ad dependence) which has a more mixed Consumer / B2B profile.

- The bottom left is the heartland of traditional Consumer publishing. Here, there are several companies with zero revenues from digital activities.

The chart demonstrates the massive range of business models with no “right answer”. The strategic intent of many companies is to move into the top left quadrant which is more digital and less ad-dependent. Yet being “digital” per se does not guarantee success. It is what the end-user wants that matters. There is little apparent pattern. However, there are clusters of similar types of organisation and some broad trends.

Let us now look at these four quadrants by zooming in on three key metrics: turnover growth, profit margins and staff productivity (revenue per full time employee).

There are no “right” business models – the most important factor is the health and nature of the market served – but here are a few key conclusions:

- The most erratic metrics are in heavily ad-dependent businesses.

- The fastest revenue shifts are still coming from B2B companies. Consumer operations are finding it more difficult to change their business models.

- Being digital per se does not guarantee success.

- Where a company is in the change process has a material effect on every metric. As do company culture, structure, agility and simple self-belief and confidence.

- Moving too fast and changing too many things at once can destabilise the whole operation.

Dive below the digital revenue topline and a number of things become clear. Firstly, despite publisher attempts to drive audience / user revenues through paid content, the digital revenue model still remains very advertiser-driven, accounting for 54% of total digital revenues for Consumer and 84% for B2B, but advertiser revenues will reduce in importance over the next two years: -2% points for Consumer and much more rapidly for B2B (-9%). In addition, the shift out of display ad sales and into native / sponsorship / content marketing continues apace.

A key additional insight is that ecommerce is not delivering the revenues that many had hoped for, even a year ago. Consumer growth in this area has stalled: the +2% point increase in share of revenues predicted last year has turned negative (-1%) – for many companies, ecommerce is turning out to be a real challenge to execute successfully. In B2B, the figure is growing (+2% points), but from a very low base of 3%.

So, overall digital revenues are clearly growing, but they…

- Remain challenging to monetise and lower margin than legacy platforms, notably print.

- Are not coming on stream fast enough to compensate for print losses.

- Require surprisingly high levels of investment and require long development and payback periods.

- Absorb significant resources – time, money and headspace.

- Demand higher tech knowledge and more sophisticated data platforms than many publishers have access to.

In the next issue, we shall dig into specific digital activities. Firstly, to have a look at which front-end content delivery platforms are getting attention from the media business. Secondly, to see what is happening with digital in more back-end areas such as marcomms and customer service.

Media Futures is an annual benchmarking survey undertaken by Wessenden Marketing in partnership with InPublishing.

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list, please register here.